2024 Annual Report

Invested in you.

This year’s report highlights another year of growth and positive community impact, emphasizing our unwavering dedication to the over 366,000 members in our Wisconsin communities and those with Wisconsin roots who we journey with globally.

As the above mural by Mauricio Ramirez celebrates, our work is most impactful when done in partnership and community.

total assets

total members

would recommend us

Rachel (center) and Shankar (right) work with Erik Julson (left), Manager of Investment Property Lending at UW Credit Union. Photo by Hedi LaMarr Photography.

Our Members

Member Focused

As a member-owned financial cooperative, every member has an equal opportunity to reap the rewards of membership. Whether depositing your piggy bank into a newly-opened savings account, finding your first or forever home, or living your best life during retirement – we’re here for every age and every stage.

- Our members save over $12.9 million annually in overdraft fees compared to the industry average1.

- We had nearly 20,000 students participate in 235 financial education sessions on campus.

- Our Member Solutions Center staff 32% of whom are fluent in Spanish answered 3,450 calls each month from our Spanish-speaking members.

- We closed $827 million in first mortgages meaning more members achieved their dreams of homeownership and building equity.

1Source: Raddon Financial Group, June 2024

Creating Affordable Housing

“They helped us figure out how to pay off the mortgage, keep the building in good repair and make this venture profitable, all while charging reasonable rental rates.” ~Rachel Lien

Rachel and Shankar were the first members to take advantage of our Investment Property Lending, which debuted in fall. The program supports local investors who are looking to grow their multifamily real estate portfolios and provide quality, affordable housing options in the community.

"We're thrilled to be able to offer this new product and support the important work our members are doing," says Julson.

Branching Out

As demand for UW Credit Union products and services grows, we continue to open branches in the communities where our members need them most. Greenfield at Southridge, Oconomowoc and Cottage Grove Road in Madison all opened this past year. We’re excited to branch out to Stevens Point, Pewaukee, Waukesha and North Ave – Milwaukee in the near future.

Benefits of Membership

We’re So Over Waiting

Instantly add your new credit or debit card to your digital wallet* and start shopping online – no more waiting for your card in the mail!

Speaking of debit cards, we’re known for our debit card designs – including colorful new options from artist Mauricio Ramirez.

Loan Payments Made Simple. Need to pay a loan from an outside account? It’s easy with our new feature to link an external account.

Melanie Ricks, Milwaukee basketball sideline + digital reporter

“With the financial education and guidance that UW Credit Union offers, you’ll be supported in your goals and decisions and set on a path to financial wellness.”

Melanie Ricks isn’t afraid to ask the tough questions … on the court or when managing her money. A member since college, she appreciates the one-on-one attention and guidance she receives at UW Credit Union.

Our Communities

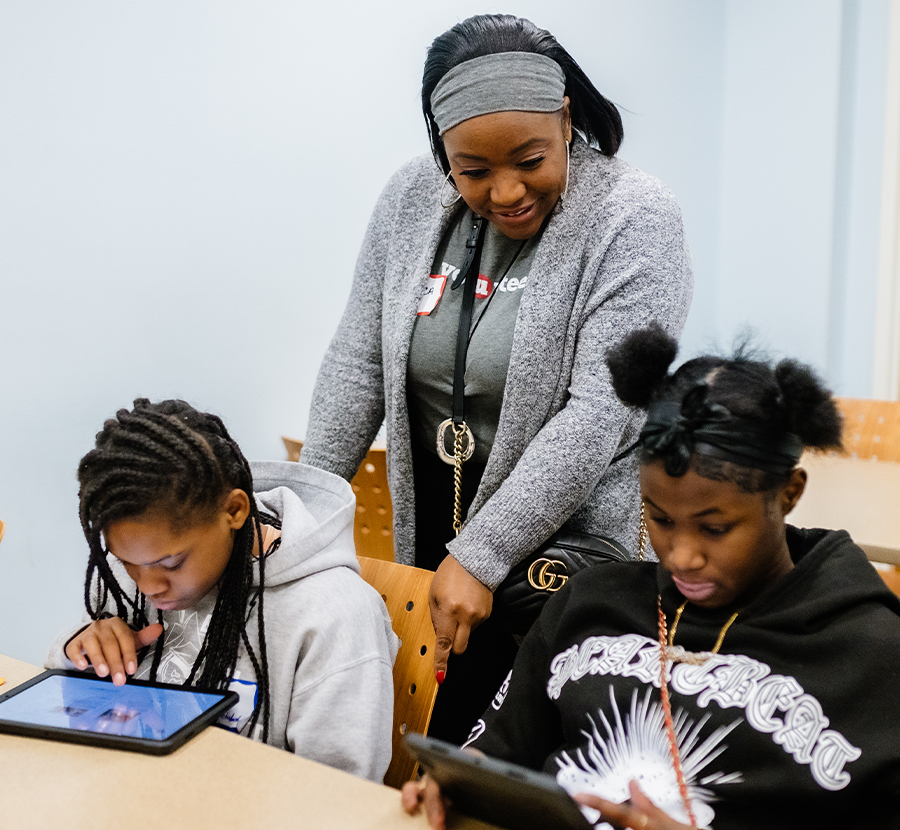

Branch Manager Donica Saffold uses her Volunteer Time Off to help students gain financial literacy through the Finance Park at Junior Achievement of Wisconsin program in Milwaukee. Photo by GM Creative Photography.

Partnering for Good

We know that strong partnerships benefit everyone, and it’s important for us to show up in the communities where our members and employees live and work. Here are just a few examples of organizations we partnered with in 2024 to help our communities thrive:

Acts Housing, Milwaukee. Getting people into affordable homes is a top priority. Acts provides homebuyer and financial counseling as well as real estate and home rehabilitation services to help more families find the right home.

Bayview Foundation, Madison. With a recent upgrade to their housing units, Bayview welcomed 50 new families and worked to ensure they had what they needed to set up their new homes. UW Credit Union provided 25 beds for kids moving into the apartments and hosted a supply drive for much-needed paper products for the whole family.

Stand Down - Madison. Providing ‘a hand-up not a hand-out’ to veterans experiencing or at risk of homelessness, Stand Down offers a wide variety of essential services so no veteran is left behind. UW Credit Union employees who are military veterans volunteered their time to provide financial education.

UW Credit Union welcomed 40 teens from the Boys & Girls Clubs of Greater Milwaukee for a day of financial literacy, career exploration and banking insights.

People Helping People

total employees

hours volunteered

economic impact of employee volunteerism

Community Support – it’s a feature of the Credit Union Difference and the reason volunteerism lives in our workplace culture. Every employee gets 16 hours of paid time off annually to use in service to local nonprofits, charities and community organizations.

2023 Accelerating Impact Award

United Way of Dane County celebrated our 2023 Community Giving Campaign achievements with the Accelerating Impact Award, given to companies who grew their financial impact most (through overall dollar amount and percentage) to create positive change in the community.

UW-Whitewater Branch Awarded

UW Credit Union received the 2024 Universities of Wisconsin Regents Business Partnership Award in recognition of our impact and commitment to the student population at UW-Whitewater.

2024 Collaboration Award

As a longstanding partner of Operation Fresh Start, whose mission is to empower emerging adults on a path to self-sufficiency, we were honored to be recognized with their 2024 Collaboration Award for our commitment and investment in the young people in our community.

2024 Financials

We continue to welcome new members organically, surpassing 366,000 total members this past year and achieving positive results that benefit everyone.

With $5.65 billion in assets and net income of $31.8 million – a 13.2% increase over last year – we demonstrate our standing as a strong financial institution.

Additionally, we hold $526.4 million in regulatory capital, which is 33% more than the amount our regulators require for their top “well-capitalized” rating of financial strength. We have the financial resources to continue serving our members through the uncertainty of inflation and other economic unknowns.

Through a $4.1 billion loan portfolio, we have assisted members during key milestones in their lives: getting into new homes, improving current homes, purchasing reliable vehicles and investing in higher education to enhance their futures.

Member checking account relationships increased by nearly 15,000 for 2024, reflecting annualized growth of 5.3%. This means more members are building strong financial futures with low-fee accounts.

Total Assets

Checking Accounts Served

Mortgage Lending

Loans Outstanding

(Download)

Dear Fellow Members:

It was a productive year at UW Credit Union – part of our most productive period ever. And while some of our work was highly visible (just scan these pages to see) other significant examples were very much behind the scenes.

For example, in 2024, we made a variety of technology enhancements that are silently strengthening our future:

- We invested in new state-of-the-art technology systems to fortify our data security, help us always be online and streamline our systems.

- We enhanced our digital banking with new loan payment options and instant debit and credit card issuance to our app.

- We improved our loan application technology, helping us get to "yes" faster and freeing up staff time to provide greater member support.

- And we put in place a variety of security upgrades to further strengthen the ways we protect your accounts and data.

While these aren’t actions that grab headlines, they are most certainly moves that make a difference. Enhanced infrastructure and new technology help us grow our business and remain competitive – so we can continue to serve you for decades to come.

They’re behind-the-scenes proof we’re invested in you.

Sincerely,

Paul Kundert

President and CEO

president@uwcu.org

(Download)